Understanding the penalties and why you need to understand every detail when staking in a particular project.

Last night my one stake of 4 became unlocked on the COTI Treasury and is kind of a worse case scenario especially where we are in the current crypto cycle. I am like everyone else trying to maximize the rewards before the big sell off happens. The problem is no one quite knows when that time is going to happen so I thought it best to lock up for another 360 days.

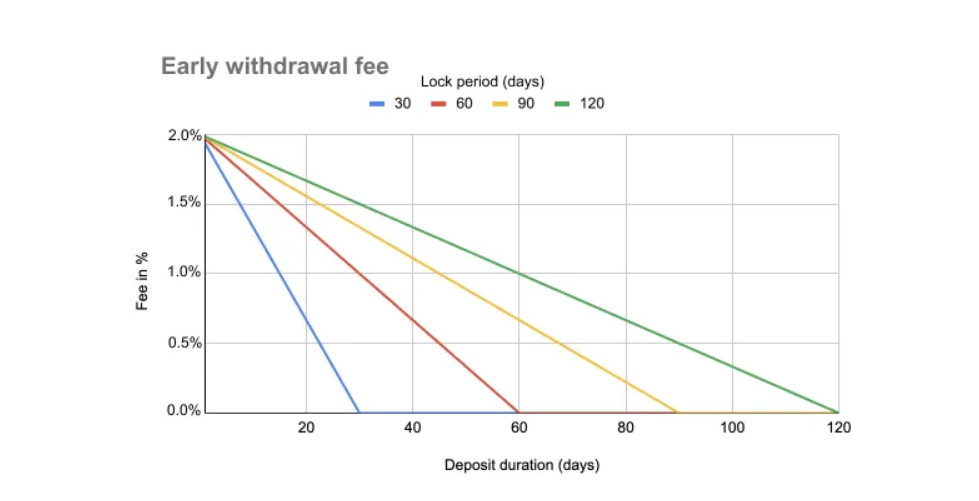

The stake of this particular pool that I have is 100K so the calculations were rather simple. Thee early withdrawal penalty is maxed at 2% so if I needed to cash out next week I would pay a penalty of 2000 COTI. Every day that ticks past the % slowly drops making the penalty smaller. The withdrawal fee is locked in at 0.25% so that is the same for everyone. The 2000 COTI is less than one months rewards of what I am currently making so I though it was best to keep these rewards constant and consistent.

My other large stake is due for renewal in December and if we have not seen the peak of the cycle by then I will leave that unlocked and not extend the locking period and wait and see where we are in the cycle.

If I had left the stake unlocked I would have only earned 1.19% as the base APR and not the 6.38% base APR when locked for 360 days. This is a loss of 5.19% which is nearly 5200 COTI for the year. This is a loss of 14.2 COTI rewards daily that is also being compounded. At this rate any penalties would be paid off within 4 months and over that time period the penalty would have been reduced by 25% as well so anything less than that time frame would be a minimal loss and one I am prepared to take.

Over the next 3 or 4 months or however long we have I expect to take the stake over 220K so forfeiting 1500 COTI in penalties is not a huge problem. These are good problems to have and there is no need to complicate this anymore than we need to.

I think these decisions are easier to make when the price is low and would be way more difficult if the price was at $5 and not the current $0.06c. A $10K price tag would maybe change your thinking as I know it would not be so straight forward. Will we see the Bull Cycle this year or will it happen in the New year as things are getting late and so much needs to happen if it is this year. The last time around in 2021 things started heating up around August/September and it was an eye opener how things transformed so quickly so we have time yet for that to still happen.

Posted Using INLEO

Comments (1)

oh ya for sure it's important to know what u staking into. I think ideally best is when you don't have to lock and just flexi staking but those are usually not that great of an apr. But if you lock for a certain amount of time you're kinda hoping the price of whatever reward you stake increases if not maybe in the end you didn't really make money ._..

Flexi is more on exchanges though and I avoid them where possible and prefer staking on the project directly.

well that's true too I guess. hbD still one of the best I think only 3 days to withdraw with 15% hehe.