KEY FACTS: SharpLink Gaming has significantly expanded its Ethereum holdings with a $53.9 million purchase of 15,822 ETH, bringing its total treasury to 480,031 ETH valued at $1.65 billion, making it the second-largest corporate ETH holder behind BitMine Immersion Technologies. This acquisition, part of a $108.57 million buying spree over 48 hours, aligns with SharpLink’s strategic pivot to build an ETH-focused treasury, boosted by a $425 million private placement and the leadership of Ethereum co-founder Joseph Lubin as board chairman. The company’s zero-leverage approach, staking over 95% of its ETH for yield, and recent appointment of BlackRock veteran Joseph Chalom as co-CEO show its ambition to lead in institutional Ethereum adoption.

SharpLink Gaming Buys $54M Ethereum as Total Treasury Reaches $1.65 Billion

SharpLink Gaming, a Nasdaq-listed sports betting and performance marketing company, has acquired an additional 15,822 ETH valued at approximately $53.9 million. This latest purchase, executed over the past several hours, brings the company’s total Ethereum holdings to 480,031 ETH, valued at approximately $1.65 billion at current market prices, according to on-chain data from Arkham Intelligence. The acquisition is part of a 48-hour buying spree during which SharpLink spent $108.57 million in USDC to secure 30,755 ETH at an average price of $3,530 per coin. This aggressive accumulation strategy positions SharpLink as one of the largest corporate holders of Ethereum, trailing only BitMine Immersion Technologies in the race to amass the world’s second-largest cryptocurrency.

SharpLink’s rapid accumulation of Ethereum began in earnest in May 2025, when the company announced a strategic pivot to build a corporate treasury centered on ETH. This shift was accompanied by the appointment of Joseph Lubin, co-founder of Ethereum and CEO of Consensys, as chairman of SharpLink’s board of directors. Lubin’s involvement has lent significant credibility to the company’s Ethereum-focused strategy, aligning it closely with Ethereum’s core development ecosystem. The firm’s commitment to ETH was further solidified with a $425 million private placement in May, followed by a filing with the U.S. Securities and Exchange Commission (SEC) to sell up to $6 billion in common stock, with the majority of proceeds earmarked for additional ETH purchases.

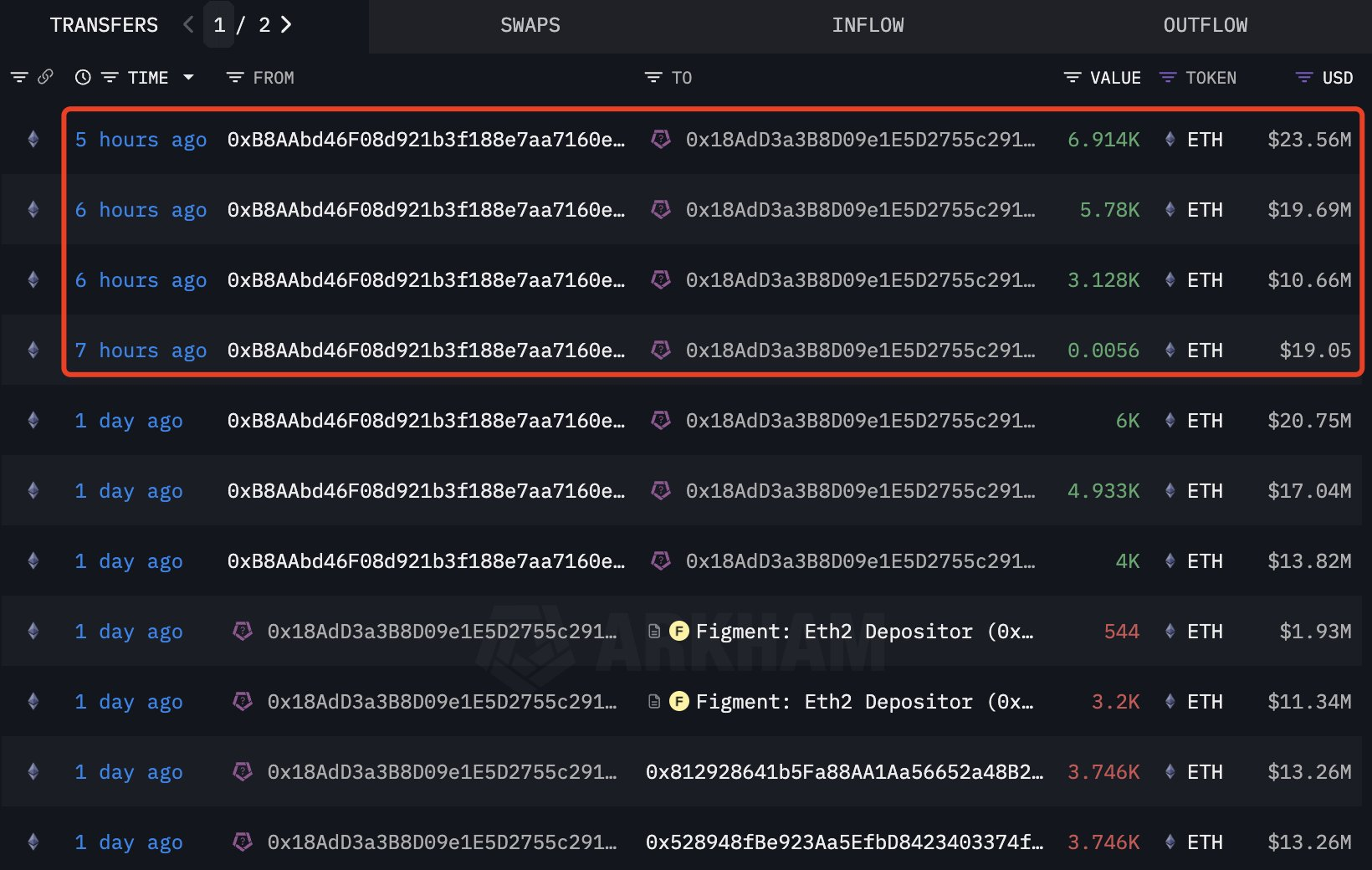

The company’s latest acquisition included multiple transactions, with the largest single transfer involving 6,914 ETH, valued at $23.56 million. On Thursday, SharpLink also spent $43.09 million in USDC to acquire 11,259 ETH at an average price of $3,828. These purchases reflect a methodical approach, with the company leveraging stablecoin USDC to execute large-scale buys without significantly disrupting Ethereum’s market price. Analysts note that SharpLink’s strategy is driven by a long-term belief in Ethereum’s utility as a foundational infrastructure for decentralized finance (DeFi), tokenized assets, and scalable Layer 2 solutions, rather than short-term speculative gains.

SharpLink’s aggressive ETH accumulation places it in direct competition with other institutional players, notably BitMine Immersion Technologies and The Ether Machine. BitMine currently holds the top spot among corporate ETH holders, with over 566,000 ETH valued at more than $2 billion. The Ether Machine, a newer entrant formed through a merger with Nasdaq-listed Dynamix Corp., recently added 15,000 ETH worth $56.9 million to its treasury, bringing its total holdings to 334,757 ETH. This acquisition, timed to coincide with Ethereum’s 10th anniversary, has positioned The Ether Machine as the third-largest corporate ETH holder, surpassing the Ethereum Foundation’s 234,000 ETH.

The intensifying race among these firms has been dubbed the “MicroStrategy of Ether” competition, drawing parallels to MicroStrategy’s Bitcoin-centric treasury strategy. Unlike MicroStrategy’s high-leverage approach, SharpLink has adopted a more conservative stance, operating with zero leverage while exploring convertible notes to scale its ETH holdings. This disciplined strategy, combined with the company’s staking of over 95% of its ETH to earn yield, underscores its focus on generating long-term value for shareholders while contributing to Ethereum’s network security.

The surge in corporate ETH accumulation reflects Ethereum’s growing appeal as a hybrid asset, blending the characteristics of a digital currency and a technology platform. Ray Youssef, CEO of NoOnes, described Ethereum as “essential infrastructure for the digital economy,” citing its staking yield, programmability, and regulatory alignment as key drivers for institutional adoption. Ethereum’s recent upgrades, including the transition to Ethereum 2.0 and the implementation of EIP-1559’s deflationary mechanism, have further boosted its attractiveness by creating supply constraints that could drive price appreciation.

Source: Lookonchain/ X

Source: Lookonchain/ X

SharpLink’s purchases have already had a measurable impact on Ethereum’s market dynamics. The company’s recent acquisition of 77,210 ETH for $295 million in late July surpassed the network’s net issuance of 72,795 ETH over the previous 30 days, signaling the potential for institutional buying to create supply shortages. Analysts, including Crypto Caesar and Merlijn The Trader, suggest that Ethereum’s price, currently testing resistance near $4,000, could see significant upward momentum if institutional demand continues to outpace issuance. Historical data support this view, with previous periods of institutional accumulation in 2017, 2020, and 2021 preceding major price rallies.

SharpLink’s Ethereum strategy has not been without volatility. The company’s stock price (SBET) has experienced significant swings, rallying over 400% after its initial ETH treasury announcement in May, only to plummet 73% in after-hours trading on June 12 due to a misunderstood SEC filing. More recently, the stock surged 28% after SharpLink reported ETH holdings of $533 million in early July, and it gained 7% following a $30 million ETH purchase in June. Despite these fluctuations, the company’s commitment to transparency and its alignment with Ethereum’s ecosystem have boosted investor confidence.

The appointment of Joseph Chalom, a 20-year BlackRock veteran, as co-CEO in late July further signals SharpLink’s ambition to execute a sophisticated global strategy. Chalom’s experience in asset management is expected to enhance the company’s treasury management and risk controls, positioning it to compete effectively in the institutional ETH race.

Broader Implications for Ethereum and Crypto Markets

SharpLink’s aggressive ETH purchases add to the stats of corporate adoption of digital assets. Across 50 participants, strategic ETH reserves have reached nearly 1.34 million ETH, valued at $4.1 billion. This growing institutional interest is reshaping Ethereum’s market structure, with corporations increasingly viewing ETH as a core component of diversified portfolios. The rise of Ethereum-based exchange-traded funds (ETFs), such as BlackRock’s iShares Ethereum Trust, which holds 1.7 million ETH worth $4.5 billion, further underscores the asset’s institutional appeal.

The company’s stated goal of holding 1 million ETH, representing nearly 1.38% of ETH’s circulating supply, signals an ambitious long-term vision. If achieved, this target could further tighten Ethereum’s supply, potentially driving prices higher as institutional demand grows. Meanwhile, SharpLink’s $1.65 billion Ethereum treasury positions it as a leader in the corporate adoption of digital assets. With Ethereum’s role as a backbone for DeFi, tokenized securities, and Layer 2 scalability solutions becoming increasingly clear, SharpLink prides itself on its strategy being in the right direction.

Information Sources:

If you found the article interesting or helpful, please hit the upvote button and share for visibility to other hive friends to see. More importantly, drop a comment below. Thank you!

This post was created via INLEO. What is INLEO?

INLEO's mission is to build a sustainable creator economy that is centered around digital ownership, tokenization, and communities. It's built on Hive, with linkages to BSC, ETH, and Polygon blockchains. The flagship application, Inleo.io, allows users and creators to engage & share micro and long-form content on the Hive blockchain while earning cryptocurrency rewards.

Let's Connect

Hive: inleo.io/profile/uyobong/blog

Twitter: https://twitter.com/Uyobong3

Discord: uyobong#5966

Posted Using INLEO

Comments (2)

https://www.reddit.com/r/ethereum/comments/1mguwwm/sharplink_gaming_buys_54m_ethereum_as_total/ This post has been shared on Reddit by @dkkfrodo through the HivePosh initiative.

Congratulations @uyobong! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

You can view your badges on your board and compare yourself to others in the Ranking If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: