Price of Arbitrary

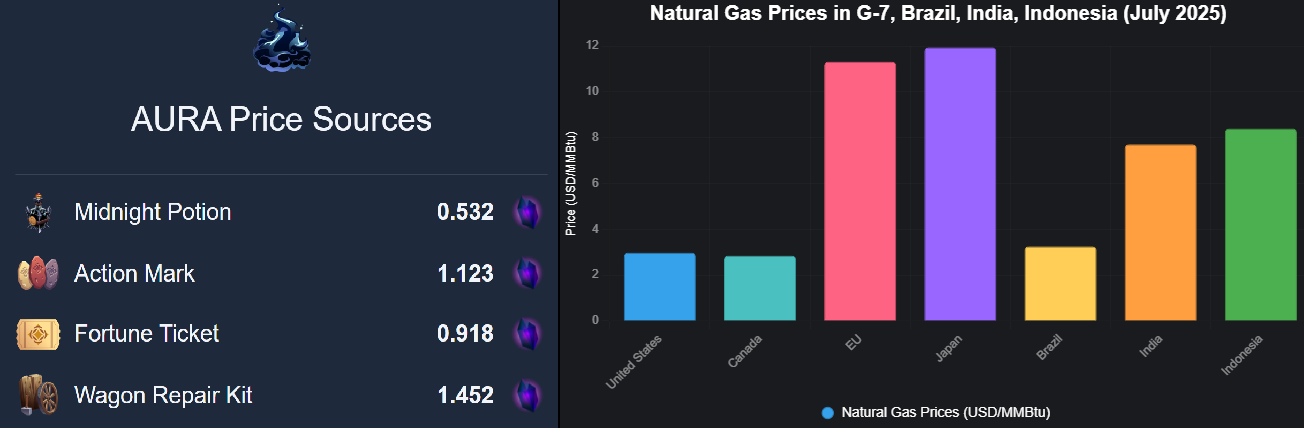

Today I was having a discussion with @beaker007 after he posted the price of Aura in the Splinterlands discord. His tool calculates the Price of Aura, based on variety of different use cases. Although it is the same Aura, but it can be valued differently based on the end use case of the the sold product. This is simply because, Aura can't be sold, it is soul bound. This immediately reminds of a very similar real live situation that I personally deal with a lot. It has to do with price of Natural Gas. As you know Natural Gas requires transportation in a pipeline. Therefore, it is not easy to transport it across different continents. Though US has a lot of Nat Gas production (and remaining resources), it is not easy to transport or export that to Europe (cheaply), where the prices are high due to low production and high demand. So while US can enjoy prices near $3 at Europe prices can be as high as 4X!

| Country/Region | Price (USD/MMBtu) |

|---|---|

| United States | 2.98 |

| Canada | 2.85 |

| EU | 11.32 |

| Japan | 11.94 |

| Brazil | 3.25 |

| India | 7.71 |

| Indonesia | 8.40 |

This is largely true for almost any commodity, but especially true if a commodity is hard to transport or store, like Natural Gas. It is possible to liquify Nat Gas, in the form of LNG, but that is a costly process and requires a lot of upfront investment to build a LNG plant. So following are the reason, Nat Gas prices are so variable across continents and countries:

| Reason | Description |

|---|---|

| Supply Availability | Abundant U.S./Canada shale gas keeps prices low ($2.85–$2.98/MMBtu). EU/Japan rely on costly LNG imports ($11.32–$11.94/MMBtu). |

| Demand Fluctuations | Seasonal spikes (e.g., EU winter, India summer) drive volatility. Industrial use in Brazil/Indonesia varies ($3.25–$8.40/MMBtu). |

| Geopolitical Factors | Supply disruptions (e.g., conflicts) impact EU (TTF) and Japan (JKM). Indonesia’s prices are less affected but tied to LNG trends. |

| Infrastructure Constraints | Limited EU/India/Indonesia pipelines or LNG terminals raise costs. U.S./Canada’s robust infrastructure stabilizes prices. |

| Currency and Market Structure | Exchange rates and regulations (e.g., Indonesia’s cost-plus, India’s imports) cause variations. EU/Japan face global market swings. |

| Storage Levels | Low EU storage spikes prices ($11.32/MMBtu). High U.S. storage lowers prices ($2.98/MMBtu). Brazil/Indonesia have limited storage. |

| Energy Policies | EU’s carbon pricing and Japan/India’s energy transitions raise costs. U.S./Canada benefit from stable fossil fuel markets. |

If you are wondering about what is TTF and JKM, they are simply standard pricing created to stabilize prices by different 'cartels' (read governments or private entities)

TTF (Title Transfer Facility): A virtual trading hub in the Netherlands for natural gas, used as the primary pricing benchmark for Europe.

JKM (Japan Korea Marker): A benchmark price for LNG spot market transactions in Asia, published by Platts, primarily reflecting delivered LNG prices to Japan and South Korea.

Contango and Backwardation

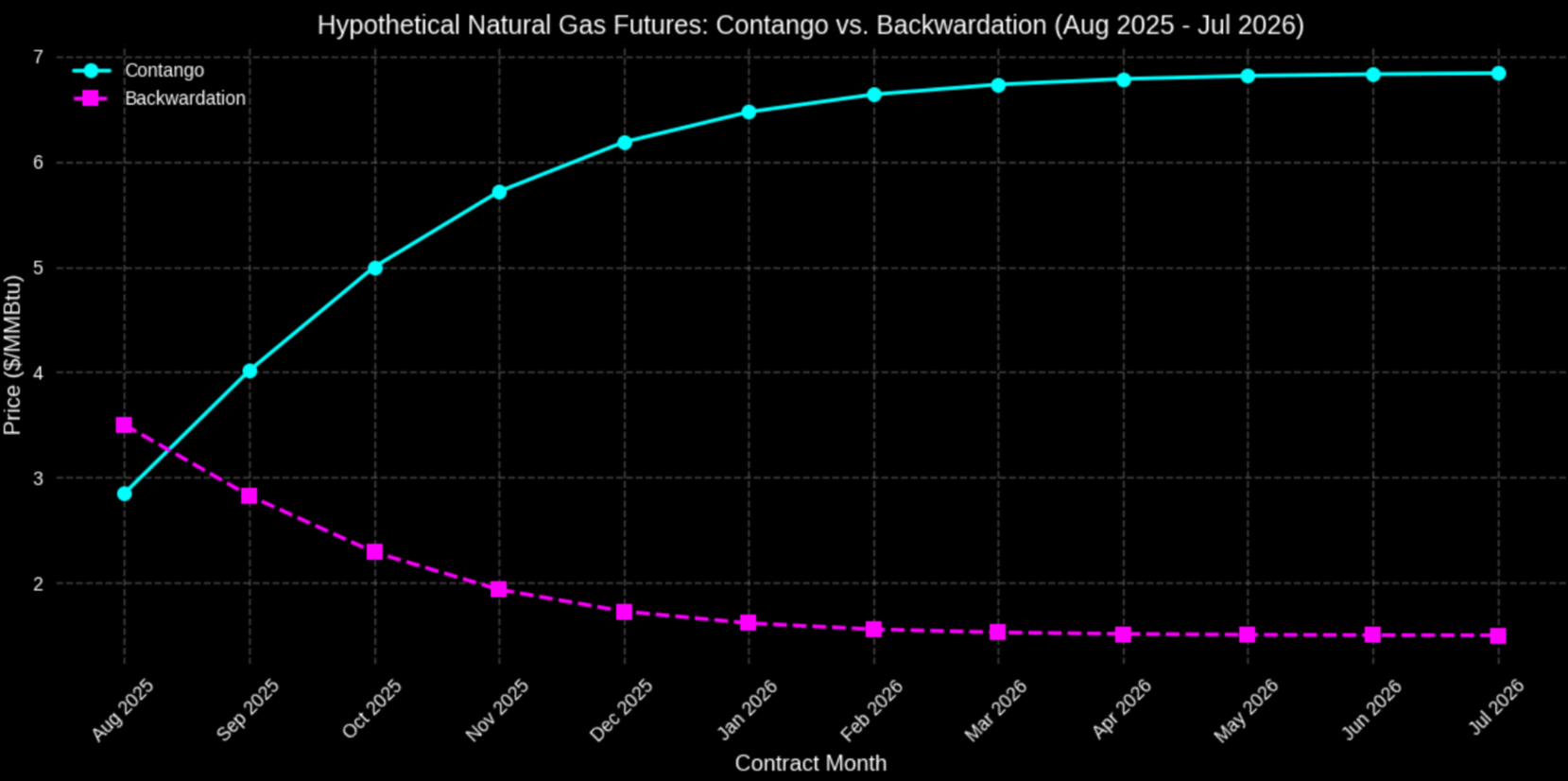

I love terminology. Trust me these terms are not made up by me :) The price variation above is based on geography. However, there is another possibility of price variation and that is due to time. Most widely used commodities are traded as futures.

Commodity futures are standardized contracts traded on exchanges to buy or sell a specific quantity of a commodity, like natural gas, at a predetermined price on a future date. They allow producers, consumers, and investors to hedge against price volatility or speculate on price movements. In the context of natural gas, futures are traded on exchanges like NYMEX (e.g., Henry Hub contracts), with prices reflecting market expectations of future supply and demand.

Nat Gas futures, just like other futures, is a standard contact worth 10,000 MMBTU. So if the price of Nat Gas is $3, a single contact is worth $30,000 US. The contracts expire each month at the end of business or the 3rd Friday of each month.

| Contract Month | Contango Price (USD/MMBtu) | Backwardation Price (USD/MMBtu) |

|---|---|---|

| Aug 2025 | 2.85 | 3.50 |

| Sep 2025 | 3.53 | 3.20 |

| Oct 2025 | 4.13 | 2.95 |

| Nov 2025 | 4.63 | 2.75 |

| Dec 2025 | 5.03 | 2.59 |

| Jan 2026 | 5.34 | 2.47 |

| Feb 2026 | 5.59 | 2.38 |

| Mar 2026 | 5.79 | 2.31 |

| Apr 2026 | 5.94 | 2.26 |

| May 2026 | 6.06 | 2.22 |

| Jun 2026 | 6.16 | 2.19 |

| Jul 2026 | 6.24 | 2.17 |

This is hypothetical prices of Nat Gas futures in two different scenarios. In one case, the future prices of Nat Gas contract rise in value, this is called Contango. In the other case, the prices fall in value in future months, this is called Backwardation. That's about it.

Most commodities requires a storage cost, some are higher than others, so typically most commodities are in contango, that is the normal situation. But if there is an expected surplus is envisioned today, chances are it could be in backwardation.

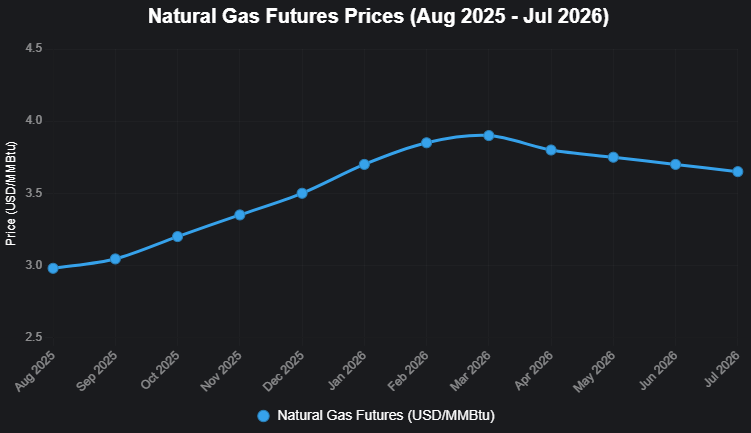

Here is a current real future contract prices for Nat Gas (Henry Hub). It is clearly in contango till March, which is the end of the colder season, after that it is slowly in slight backwardation.

There you have it. Price is never constant, but at a given time, it is always right! :)

Comments (5)

So true. Here in Cuba we see it all the time with the dollar: its price changes depending on urgency or who’s selling. That directly affects the cost of many services. In the end, we have a kind of crazy system, disconnected from the real world… but it still ends up determining the value of everything.

Price of everything is arbitrary. Bread, Egg, Meat...whatever you can think of.

I'm sure it doesn't factor into the price calculations, but it probably should, and that's the price of capping all the steps in the process of Nat Gas to prevent methane leakage. If some countries regulated and enforced acceptable levels of leakage, and others didn't, that'd also affect the price of the product and transportation.

There was a satellite that was able to track methane leaks over time, but I think it lost contact with the Earth. Hopefully a new one is launched.

You are correct. It is tracked somewhat but cannot be factored in. The Henry Hub price is the net sum total of all actions that is reflected in the price.

With Natural gas there is also Oil to Gas Price Ratio that used to be around 10, but that went out of the window a while ago and now is much higher. That might play into the future pricing of gas? Also strange to to have natural gas price in backwardation as inflation is supposed to make things more expensive in the future? Does that mean that demand for gas is expected to drop or the supply to increase in the future?

The ratio you talk about is called energy ratio. It’s about 1:6. Because energy of 1 barrel of crude oil is approximately 5.8 MMBTU. Traditionally prices were equivalent of that a long time ago.

But the price ratio is meaningless lately. It’s been as low as 3 and as high as 54.

Backwardation has nothing to do with future price though. It is the future contract prices today :) which is speculation. Not real spot price.

Effect on inflation is slower and longer wave length.

Future prices are instantaneous and much shorter wavelengths.

As discussed in Discord — not really my cup of tea, but I really appreciate the depth of information and how these mechanisms work. Even if I won’t be using this kind of modeling in real life, it’s still fascinating. And in the context of Splinterlands, it's definitely insightful. Just a reminder (as I always try to disclaim): Aura pricing is just a snapshot in time, and should be treated as such.

Just like Aura pricing is a snapshot in time, so are Nat Gas pricing. Or any pricing for that matter. So my point is no disclaimer needed in this case :)

My natural gas isn't too bad this time of year, but it will definitely go up come winter. My electricity bill has been off the chart lately which is nuts.

Obviously! Lol!

I am in Houston and it’s 100F here!

Is it humid too or a dry heat? We had some weeks close to 100 with really bad humidity. We had to run the A/C non stop and it added about $100 to my monthly bill.

oh in houston it is always near 90% humidity!

Yeah, no thanks!